We get it – bill review companies get a bad rap.

This post comes in response to Joseph Paduda’s latest blog write up on Uncomfortable Truths at this year’s NWCDC, a piece that highlights the missing transparency between TPAs and employers, which further decreases the quality of managed care. It’s a very well written post and it details that companies only care about two numbers: how much each processed claim costs and how much money they are ultimately saving. When it comes to cost management, they want the first number to be low and the second number to be high.

Paduda says issues arise when there is non-transparency between a TPA and their clients about what bill review vendors actually do and how much money they are making. In summary, he says this:

“Transparency is what’s missing; contracts between and among TPAs and employers don’t allow employers to see the financial relationships between the TPA and managed care companies and providers and understand the motivations and incentives inherent in those relationships.”

Although he is referring to the medical industry in this scenario, we can vouch that we heard similar stories at the recent Trucking Industry Defense Association (TIDA) Conference in October.

The Difference Between a Cost Management and Bill Review Company

As a litigation cost management company, we are often confused as a traditional bill review company. Yes, this is a slightly different setup than the medical world, but in theory, we have a similar job. We always get approached asking us if we can audit and slash bills between them and their firms. The answer is a hard no.

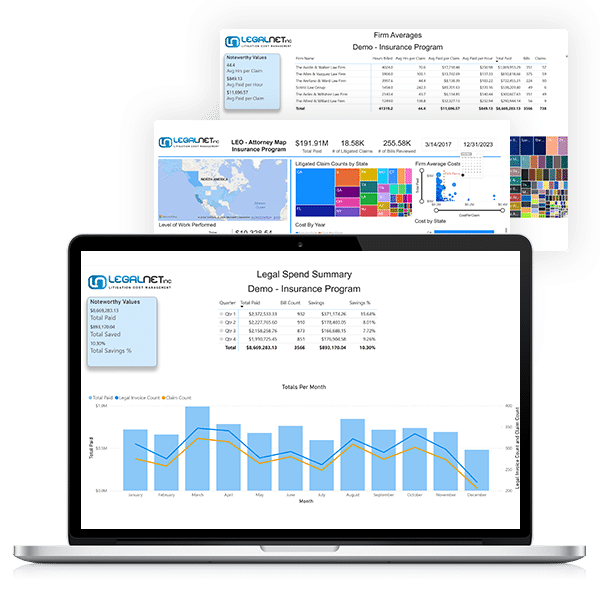

We represent our clients and their firms alike and the one thing that sets LegalNet apart from the rest is that we collect data. Our goal is not to cut anyone’s compensation – we focus on processing a firm’s invoice so that:

- The firm can get paid on time

- The client can drill down on all of the data to better understand what they’re spending money on and how to better prepare for the future

Data is king to us. Through our process of reviewing invoices, we produce savings only when we run into red flags that our clients have asked us to watch for, including duplicate bills or invoicing for a line item that the client does not cover. Other than that, we exist simply to turn mountain high stacks of invoices into readable and actionable information about litigation. For the large corporations we work with, let’s just say that it is a lot of useful information.

In addition, we pride ourselves in promoting transparency between all parties involved: client, TPA, and firm. We know that this is the only way to achieve actionable results and success.

And The Final Takeaway Is…

We agree with Paduda. We have seen competitors that focus on discreet relationships and who make a living by cutting someone else’s. It’s just not right.

If you are in the business to find a vendor to help you with your cost management – whether it be litigation or managed care – know exactly who you’re working with and what kind of results you want. We’ve seen first hand that challenging every item on an invoice may save a few dollars but the cost of adding friction with your defense counsel could end up costing more down the road.