Navigating the waters of insurance is already tricky to start with, but to make things exciting, the industry is adding another element of protection: cyber risk insurance. There are the basic lines of coverage: auto, house, life, and if you’re lucky — boat! But for those of us who have a majority of our work and business online, it’s important to be aware of the things that can go wrong there.

What is cyber risk insurance (CRI)?

This is a newer offering in the insurance industry and can also be found under “liability” or “information security”. Not all companies carry it at this point, but it is gaining more popularity. CRI can help protect you if your intellectual property is damaged within the cyberspace. With that being said, terms may be negotiable since the industry is still working on standardizing coverage format.

It’s a common mistake to think that only big companies need CRI. This is not true. Whether your customer’s credit card information gets stolen or if a laptop with proprietary information goes missing, you have to be ready to take actionable next steps.

Do you need CRI?

If you are a company with sensitive data storage or an online processor with possibilities for hacks, breaches, or malfunction, CRI may be for you. Here are a few possibilities of issues you could face:

- Data or software corruption due to viruses

- Theft of sensitive records

- Denial-of-Service attacks

- Remote control and manipulation of systems

- Counterfeit computer equipment and microprocessors

- Espionage

In addition, CoverWallet says that it may be mandatory to notify users when a company has been breached. Because of that, “Notification can quickly become very expensive, especially if you need to communicate with thousands of customers via mail, making this type of insurance an affordable way to comply while mitigating costs.” It may be better to make yourself safe before it’s too late.

Who is most commonly at risk?

According to BarkerHostetler’s Data Security Incident Response Report:

Top 3 Industries

- Healthcare

- Financial Services

- Education

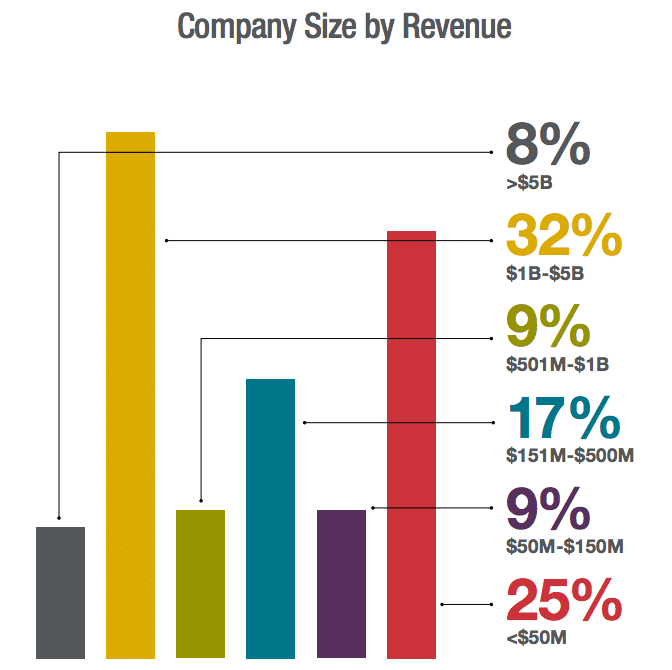

Top 3 Company Size by Revenue

- $1B – $5B

- < $50M

- $151M – $500M

In addition, 31% of most breaches are due to phishing, hacking and malware followed by 24% in employee actions and mistakes. Risk is everywhere and can happen to anybody.

Who offers CRI?

Not many companies offer this new-age insurance policy, but you can start comparing options between Burns and Wilcox (recommended), CoverWallet (good for small businesses), Deloitte, Travelers, Marsh, and AON. As you can see, every company offers different solutions, so it may be worth a try to choose one you like and discuss pricing and coverage possibilities.

Key Takeaways

Like all insurance, it’s always a gamble to invest in. Consider yourself lucky if you don’t actually ever have to call on it but what if you do and you don’t have it? It’s best to keep your company safe if you are dealing with private information and potential lawsuits. We recommend calling a few of the companies above and discussing your needs with a professional agent.