When it comes to running a business, there’s a lot at stake. Granted, you’re finally the head honcho of your own company, but with that comes great responsibility. Whether you are a retail space or an online business, general liability (GL) is an essential first step to covering your assets. One mistake could cost you a lot and GL helps cover the basics. But, is it enough? We chatted to our friends at CoverWallet for some advice.

What does General Liability cover? What are some things it does NOT cover that people usually think it does?

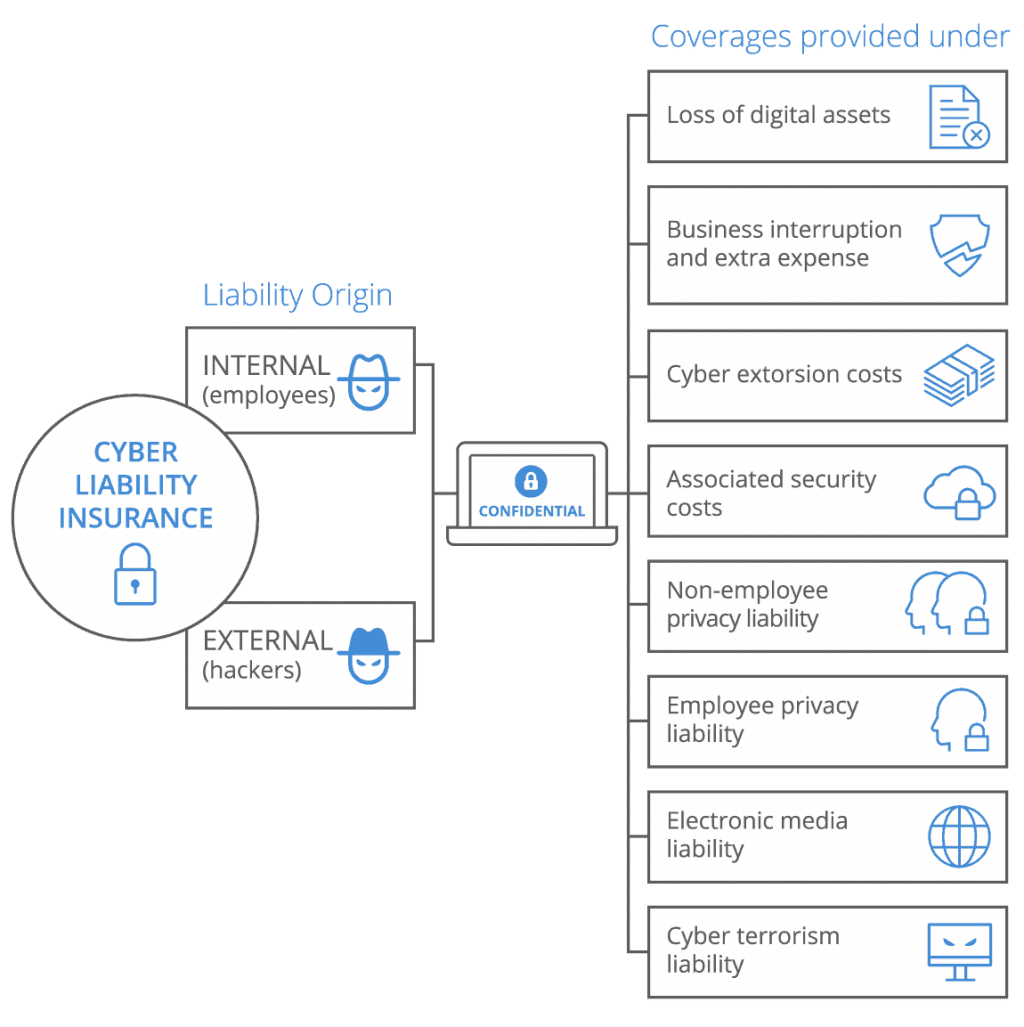

“General Liability insurance covers a company or individual for damages that are found to be their fault. For example, if you are a painting contractor and a paint can falls and hits someone in the head while you’re on a ladder, they may sue you. Here, your General Liability Insurance would kick in and cover the defense costs as well as any damages that need to be covered, up to the per occurrence limit of your policy. General liability will not cover things that are not in its exact scope or have been endorsed onto the policy. While every policy is different, typical exclusions can be – errors and omissions, cyber liability, media liability.”

Image from CoverWallet

What questions do you need to ask of your business to determine what else you need covered?

“What sort of work am I doing? Do I have employees? Do I keep customer records online and am I open to them being hacked? These are just a few questions to ask yourself as each-and-every one of those leads to a different type of insurance policy. Do you need Media Liability? Product Liability? Errors & Omissions? Directors & Officers? Cyber Liability? Worker’s Compensation? EPLI? The list can go on and on, which is why it’s best to discuss your business practices with a knowledgeable agent who can steer you in the right direction.”

What kind of insurance do you think supermarkets need to have?

Why is GL needed in this day and age?

“General Liability is needed today just as it has been needed in the past for one main reason: It mitigates a client’s risk of having to pay expensive defense costs and even more expensive legal fees. When someone gets hurt due to the negligence of another, they will sue, and lawsuits get expensive. On top of that, a court’s decision could mean tens of hundreds of thousands in monies owed to the hurt party. When this happens, the General Liability policy will be what’s there to protect the client. Instead of having to close the business, sell personal items or even worse go into bankruptcy due to a bad lawsuit, the client has the peace of mind knowing that the insurance will take care of the monies owed, so that they can focus on their business.”

If GL is not enough, what else should the business consider?

“Depending on the type of work a business does, any of the coverage types listed above can be advisable. In the short term, a good General Liability policy can be paired with Commercial Property or written as a BOP (Business Owner’s Policy) which would cover the GL as well as any property owned by the business up to the limit quoted (computers, tables, equipment, etc.) If you have employees, then Worker’s Compensation is legally required in almost all 50 states. These are the first insurance types a business should consider.”

Is GL only for commercial storefronts? Does it protect online businesses, too?

“General Liability is for more than just commercial storefronts; it is for any business, whether it is mercantile, office, professional and yes, even internet-based. One very important coverage of General Liability is Products and Completed Ops. Let’s say you have a home-based crafts business that sells crafts online. If your product causes injury to someone, your General Liability policy may cover you.”

What kinds of things can businesses negotiate with a GL insurer?

“Many insurance carriers offer discounts and packages as well as multi-policy discounts alongside which pricing can be negotiated up or down by choosing what sort of deductible you have and what exclusions do and do not apply. A $2500 policy can easily have its price brought down by up to hundreds by changing the deductible from $500 to $1000 or more (this is the money that the insured will pay out of pocket in the case of a claim before the insurance pays the rest).

With some contractors, there are discounts of up to 25% if they do not do any work on new construction buildings without a certificate of occupancy yet. If you need Additional Insureds, you can add those to the policy, with some companies in the form of one additional insured per request with a fee. Others have blocks of Additional Insureds that the client can buy up front at a fixed rate. Some companies offer a Blanket Additional Insured option that lets the client add as many Additional Insureds as often as they need. All of these things can be negotiated and have an impact on pricing.”