After a short hiatus from our Thursday Thought Leader series, we are back with a brand new lineup of really incredible industry professionals!

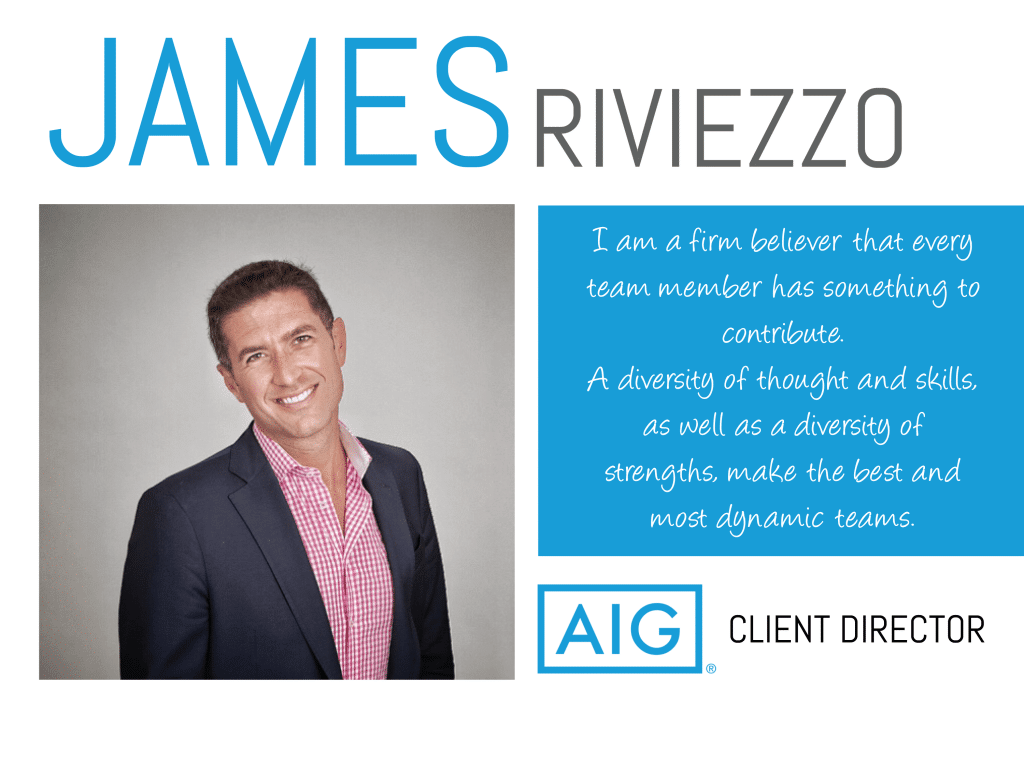

Today’s spotlight is on James Riviezzo, Client Director at AIG. He’s held a handful of impressive roles at several major companies, a difficult feat that looked like a walk in the park for James. We had the lucky opportunity to learn more about who he is and how he navigates the world of team culture and client relationships. As someone who has gracefully paved his way to success over the years, we’re taking his words of wisdom to heart.

You’ve held very prominent positions at several big-name companies like Marsh, Safety National, and more currently, AIG. What is one habit or characteristic you attribute to landing these roles?

You’ve held very prominent positions at several big-name companies like Marsh, Safety National, and more currently, AIG. What is one habit or characteristic you attribute to landing these roles?

I would say that the prevalent characteristic shared by most of my professional experiences has been the responsibility to build, maintain and foster positive relationships. I think that it goes without saying that people prefer to do business with those that they know, like and trust. However, earning a trading partner’s trust is never something that is implied – rather it’s earned over time by demonstrating integrity and an over-abundance of transparency. Coupled with this mindset, I would wholeheartedly say that a key tenet to my career development has been a consistent willingness to accept risk and take on new and unique challenges. I am a naturally curious person, and believe that life-long learning is essential.

As a Client Director at AIG, how do you demonstrate effective leadership skills for your team?

In my role as a Client Director with AIG, I stress to my teams the importance of preparation and cooperation. Athletes play like they practice, and risk management professionals are no different. The more thoughtful work we put into preparing for a meeting, mediation or client engagement – the better we will perform out in the field. In my view, when a colleague is doing his or her best to allow the team to be successful – we all win. If I am doing my best to allow my teams to achieve excellence – then I am leading by example. It’s that simple.

What’s the secret formula to maintain good team culture when hiring new employees? What do you do if someone isn’t fitting in?

I don’t think that there is necessarily a “secret formula” to maintain a good team culture beyond the “golden rule”. Treating every one of my teammates and colleagues in the exact fashion that I would wish to be treated should be the rule, as opposed to the exception. I am a firm believer that every team member has something to contribute. A diversity of thought and skills as well as a diversity of strengths make the best and most dynamic teams. I also try and promote a demanding, but enjoyable work environment. Work should be hard – but why not make it fun? That said, there are circumstances when certain employees are simply under-prepared for their role, unmotivated to be better, and therefore producing a low-quality work product. Removing an employee from a client engagement or product can be a difficult conversation, but I generally witness relief on the effected employee after initiating a change. Good managers should never be fearful of instituting change, rather they should feel empowered to make new mistakes every day, as opposed to wasting time and energy repeating old ones.

You also work with many important clients. What’s your secret to successfully maintaining a good relationship with them?

AIG is a large and complex company. We operate in over 80 countries around the world, and deliver and enormously diverse solution set for our trading partners and insureds. With just one client, AIG can find itself providing property coverage on 23 manufacturing facilities around the world, insuring thousands of fleet vehicles, mitigating millions of dollars of cross-border accounts receivable risk with a trade credit policy and backstopping the risk of a network intrusion via cyber insurance. All of this means that clients expect a lot from us – without exception. Each day, we pay almost $100 million in claims to clients. That said, in the absence of paying out a customer claim, what we strive to provide our clients is people, transparency and trust. Our ranks overflow with dedicated experts in risk management and mitigation. We engage early and often with our insured to provide clarity of our process and methodology of structuring and pricing risk. We back these efforts with the trust of our “promise to pay” in the instance of loss. For me, maintaining good client relationships starts and ends with being responsive to an insured’s diverse needs and requests. Integral to that task is simply doing what I say I will do. Timely follow-up is often a differentiator, and I generally will pick up the phone and engage a colleague or client as opposed to sending an impersonal email. Staying on top of tasks can be difficult. My low-tech solution to this challenge is that I constantly keep a pad of paper next to my phone, where I jot down all of my call notes and “to do’s” for the day. I try to review this list each night before leaving the office. By the end of the day, the page is often borderline illegible, thus I will re-write my list for the next day, ranking my deliverables in order of importance. I am sure there is an iPhone app that is superior to my process – but I prefer “hi-touch” solutions to those that are “hi-tech”.

Who are your thought leader role models and what key tips have you taken from them?

A person that has inspired me in my personal life and professional career is New York City restaurateur and CEO of the Union Square Hospitality Group, Danny Meyer. Mr. Meyer’s businesses are renowned, not only for their food, but for their distinctive and celebrated culture of “enlightened” hospitality. As our economy has migrated steadfastly towards providing services, as opposed to manufacturing physical goods, I think that many organizations have lost the timeless art of servicing their clientele. On the surface, the insurance industry may seem to have little in common with the restaurant business, but I feel very differently. Simultaneously paying attention to every detail, setting the table properly, cleaning up unexpected messes, and admitting fault when necessary are skills for both a kitchen crew – and an executive management team. The real challenge is allowing a customer to feel like they are the only person in the room receiving your attention and diligence. Hospitality is an art as opposed to a science. Mr. Meyer wrote a great book several years ago titled “Setting the Table: The Transforming Power of Hospitality in Business”. A fantastic quote from that book that I continue to draw inspiration from is: “In the end, what’s most meaningful is creating positive, uplifting outcomes for human experiences and human relationships. Business, like life, is all about how you make people feel. It’s that simple, and it’s that hard.”