Congratulations!

Whether you’ve been a foodie your whole life or your mom’s home cooking recipes are ready to see the spotlight, opening a restaurant is finally on the horizon. As we all know, knowing how to make a delicious dish is one thing, but running the restaurant is another job on its on. We connected with CoverWallet, an insurance company, and Shelly Nan, Co-Owner and General Manager of Bambu, to tackle one of the most confusing topics in opening restaurant doors: insurance.

THE BASICS

Do I really need insurance?

Yes, absolutely! Because of the nature of a restaurant, there are so many opportunities for something to go wrong. Whether it’s food-related illness, an on-site accident, or an unforeseen event, having insurance can help lower liability and costs if you find yourself in a lawsuit. We know, it’s not the first thing you want to think about when all you want to do is serve really delicious food, but thinking about it now can help you down the line.

Okay, so I’ll get insurance. Where do I start?

First things first, make sure you have basic details on hand, such as restaurant operations, employees, property assets, realized and projected revenue, payroll and tax ID number (FEIN). According to Maxime Rieman of CoverWallet:

“To start, your broker will need to understand how your business operates at a somewhat detailed level. This will often include questions about the products you serve (particularly whether you serve alcohol), if you make deliveries, and whether you provide catering services. You’ll also be asked about how many employees work for the restaurant (full time and part time), whether you subcontract any services, and payroll.

When talking about the property, you’ll first need to know if you have any lease requirements, which can include liquor liability coverage, coverage for fixtures and other terms depending on your agreement. Additionally, you should be able to speak about basics like the number of properties, their safety features, and any key equipment.”

Cool, that makes sense. So what kind of insurance should I get?

Great question. The most common types of insurance that people get include General Liability, Commercial Property, Workers’ Compensation, and Liquor Liability. This is not to say that there are not other options, but this is a great place to start. Here is CoverWallet’s comprehensive understanding to the categories listed above:

General Liability

General Liability coverage protects the restaurant against “third party claims”, meaning if a customer is injured or their property damaged, your business will have protection in case they decide to sue. Restaurants commonly face these sorts of issues due to food poisoning claims and general injuries, like a slip-and-fall. General Liability actually protects your business even after the customer leaves the restaurant (i.e. if they felt sick the next day).

Commercial Property

Commercial Property is important for restaurants because it provides coverage in a few different fashions. First, there’s property coverage for the restaurant and its content, like tables and chairs. Secondly, it covers restaurant equipment, like the oven and stoves. Third, for tenants, it covers improvements to the space, such as drywall, decorations, and floor coverings that you may have paid to have added to a leased property. Finally, it provides business income coverage, meaning it replaces lost profits in the case of an incident at the location, such as a fire.

Handy Tips

- Tip 1: When getting a Commercial Property policy, it’s generally recommended that business income coverage is at least 12 months ALS (actual loss sustained).

- Tip 2: Like every policy, Commercial Property coverage will only pay in the case that damage was done by a covered event. So, if there’s a fire that destroys the furniture, replacing the tables would probably be covered. But replacing items due to normal wear-and-tear is a cost restaurants need to pay for.

- Tip 3: In certain situations, a restaurant can get a bundled policy, called a Business Owners Policy (BOP). This would take the place of individual General Liability and Commercial Property policies. However, whether this is the right option depends on how your business operates. Generally, full-service restaurants should have separate policies, while limited-service restaurants (like a snack stop) may be fine with a BOP.

Workers’ Compensation

Workers’ Compensation coverage pays for work-related injuries and illnesses that arise for employees. Additionally, if an employee believes that they sustained an injury and the owner is at fault, it provides coverage for the business’s legal costs.

Commercial Auto or Hired & Non-Owned Auto

If the restaurant uses vehicles in the course of business, you’ll want coverage for them. Whether you need Commercial Auto or Hired & Non-Owned Auto depends on who owns the vehicles.

Liquor Liability

Liquor Liability is recommended if your restaurant serves alcohol. Most states have Dram Shop laws, which mean that if your restaurant serves alcohol to an inebriated person who then causes other damage (like driving drunk and crashing), your restaurant can be held liable.

Well, I don’t have a huge budget right now. Buying silverware is my primary concern! What can I get away with to start?

We feel you. But remember, you want to get insurance before you need it, not after it’s too late. It’s important to make these investments upfront, as they should be part of your budget.

If you’re opening a storefront, General Liability and Commercial Property is a must. You just never know what will happen. In addition, check with your landlord to see what insurance requirements are part of your lease agreement.

Workers’ Compensation coverage depends — some states require it regardless of how many employees you have, while others make it mandatory after three hires. Regardless, it’s strongly recommended if you have a full staff.

Vehicle Coverage and Liquor Liability is recommended as needed.

Handy Tips

- Tip 1: A General Liability policy usually excludes Liquor Liability claims, so without this coverage you may have to pay for injuries to or by a drunk patron.

- Tip 2: If an employee uses their personal vehicle for restaurant activities, the restaurant should have Hired & Non-Owned Auto coverage. Otherwise you could be on the hook in the case they’re in an accident.

Last question, I promise. What should I know about exclusions? How do I know I’m really covered?

Instances that may not be covered but may be a huge hit to your business if they occur include:

- Flood and Earthquakes: This is typically not covered in Commercial Property, but if you live in a high-risk area, consider adding this on in a separate policy.

- Electricity: What would happen if your place went dark? Would too much food spoilage lead to a massive amount of monetary loss? If you run a high-end restaurant with expensive refrigerated goods, then think about covering this possible scenario.

- Normal Wear and Tear: If you’re breaking plates and cups, it doesn’t count under this policy unless it’s under a covered event.

- Business Income: This is often covered in your Commercial Property policy, but you can also opt for different levels of coverage.

- Liability Limits: “Liability policies have limits on how much they’ll cover. You’ll want to check the occurrence and aggregate limits (per-event and total). If you’re uncomfortable with these and think they’re too low, you can get an Umbrella policy to add additional liability coverage,” says Rieman.

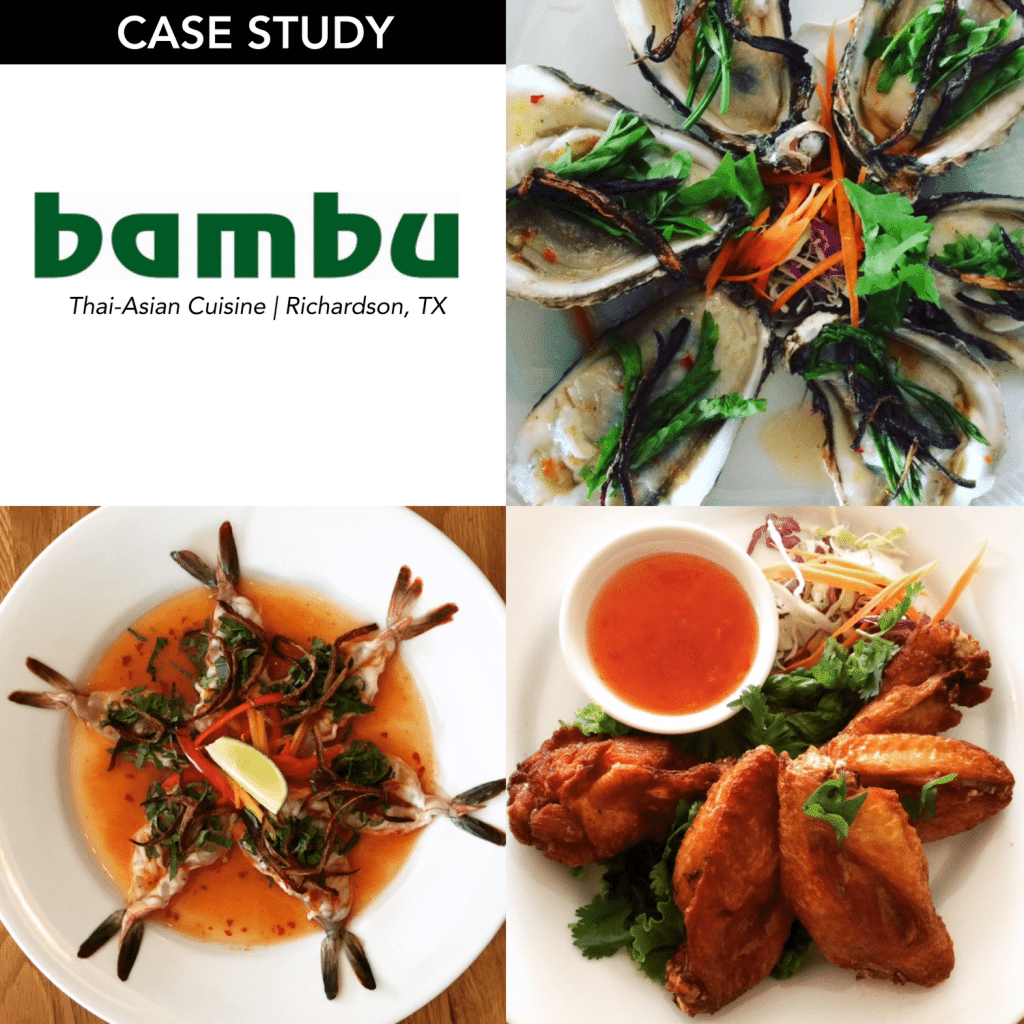

CASE STUDY: Bambu, a Thai restaurant in Richardson, TX

Shelly Nan opened Bambu in 2010, a concept inspired by her mom’s incredible home-style Thai cooking. A big part of the restaurant is wine pairings and they have been extremely successful with this model. “Wine brings out another aspect of your taste pallet. So when you pair the right wine with the right food, you are able to enjoy it more.”

How She Tackled the Insurance Process

“It’s pretty confusing when you first start because it is all about projection and assumptions. You just don’t know how much you’ll be making. The more you make, the more the insurance will cost. For example, if you project higher liquor sales, then you are at a higher risk, so it all depends on those annual sales.

“The way we handled insurance was they first asked us what business we formed — if we were individual or incorporated. Then, they ask us about coverage and what’s expected from the landlord and the building we’re occupying. From that standpoint, you have to also cover your business assets, like if someone gets sick, you get involved in a lawsuit, or someone gets hurt at your establishment. If you serve alcohol in your premises, then you have to get covered there, too.

Also, keep in mind that it’s adjusted every year according to your annual sales and if you have any pending lawsuits against you.”

On Handling Confusing Policies

“Our landlord required that our policy covered at least $2M. With my policy, I also have a full bar and in order to stay up-to-date with coverage, all of my employees have to take a certification on serving alcohol so that I won’t be liable if someone drinks at my establishment and then gets into an accident afterward.

You also have to double check your deductible just in case the restaurant shuts down or the electricity goes out. You could have a loss right there. Most of the things in the restaurant could spoil and if that happens, it’s not your fault but you have to have back-up and information that it’s not your fault. If you get a good insurance person that describes to you the whole process, it makes it all so much easier.”

Was It All Worth It?

“It has been worth it for me. With this restaurant, I established another family within my staff and employees. It’s been a pleasure seeing my business grow and being able to provide not just for myself, but for other people.

Remember, everything is a risk. You just have to do it the right way. If you take shortcuts and things happen, it could really hurt you.”

Have more questions? Tweet us @LegalNetInc and @CoverWallet. We’ve got you covered!